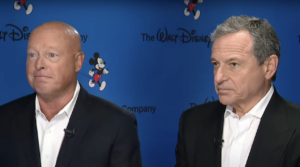

So now we have two defining, insider-sourced articles about the backstory behind the failed succession at The Walt Disney Company from former (and now current, again) CEO Robert Iger (pictured above) to, and from, successor/predecessor Robert Chapek. The first came in December from the Wall Street Journal. Now we have an even lengthier piece from Alex Sherman at CNBC.

Robert Chapek & Robert Iger/IMAGE: CNBC via YouTube

I’m not a fan of articles built almost exclusively upon unidentified sources, but in this case it’s understandable. It would be more suspicious if either Iger or Chapek came out of the report shining, but in this case, almost everyone involved — the CEOs, board members, and top executives — appear as either ego-driven, immature and/or incompetent.

The overarching narrative since Iger returned as CEO nearly a year ago, amplified by the corporate business media, has been this: Iconic Iger finally retires; disciple Chapek makes poor decisions and can’t manage through COVID; hero Iger returns to save the company. The actual results have been worse than imagined, as Disney shares are trading at nine-year lows of around $80 — dipping briefly below that mark earlier today.

Both articles reveal extreme dysfunction behind the scenes, but CNBC’s report highlights the almost unimaginable depths to which the company has sunk. As we have extensively documented, Disney’s emphasis on its woke political agenda and pushing adult sexual themes on its children programming have harmed all its revenue-producing products: linear and streaming television, theatrical releases, and theme parks and resorts. To be sure, there are other headwinds for the business including cord-cutting of subscription television and film superhero fatigue, but for the most part, Disney’s leadership has steered its historic legacy into a ditch.

Left-wing website The Verge compiled a list of the “pettiest moments” from CNBC’s account, and Chapek’s sins are not overlooked, but it’s clear Iger never wanted to leave; never did give up his power; undermined his hand-picked successor; and has full control over Disney’s board of directors — as the CNBC article reports:

By 2019, Iger had personally selected every member of the board, which is surprisingly lacking in media and entertainment experience. Iger is personally close with several of them, including Nike Executive Chairman Mark Parker and General Motors CEO Mary Barra. In addition, the wife of another director, Michael Froman, then vice chairman of Mastercard and now president of the Council on Foreign Relations, had been housemates with Iger’s wife, Willow Bay, at the University of Pennsylvania.

It was from Parker that Iger got the idea for his succession plan, according to people familiar with the matter. In October 2019, Parker, who was then CEO of Nike, announced he would remain as executive chairman of Nike while passing the torch to John Donahoe.

The report depicts an indignant Iger over an unappreciative Chapek:

At the end of a June board meeting, conducted via Zoom, Disney directors asked Iger — but not Chapek — to stay on the call for a customary “executive session.” According to people familiar with this conversation, Iger told the board his relationship with Chapek had soured and that Chapek wasn’t exhibiting proper leadership qualities. The pandemic was shaking Disney to its foundations, and Iger believed Chapek should be working more closely with the man who had run the company for the last 15 years.

CNBC’s Sherman contends that Chapek should have recognized that Iger retained his power through the backing of the board that he hand-picked:

Breaking with Iger was clearly not a sound strategy. Iger had nominated every member of the board, built the company in its modern form, and repeatedly struggled to walk away from the job. Had Chapek been able to better compartmentalize his insecurity over his job status, it’s possible he could have brokered a peace with his boss…

Succession planning is one of the few responsibilities that fall squarely on corporate boards. Turning Disney over to a CEO without giving him control of creative — the heart of the company — led to confused leadership and a near-inevitable power struggle. By skipping the one-on-one meetings with Chapek before appointing him, the board didn’t know how his personality would mesh with Iger’s if leadership clashes arose…

Disney is likely to choose its new CEO around the beginning of 2025, according to a person familiar with the matter. Iger has begun vetting candidates already, the person said. The board and Iger are considering processes in which Iger first names a chief operating officer as his heir apparent and sticks around as CEO or, once again, moves to an executive chairman role in 2025 to help with the transition. Either way, this would leave a little less than two years for Iger to hand the reins to a new leader — about the same amount of time he had with Chapek.

Prior to Disney’s annual meeting in April this year, National Legal and Policy Center called for its fellow shareholders to vote against the entire board, as an expression of disapproval of their oversight of the company. We filed a 27-page proxy memo at the Securities and Exchange Commission to argue our case against the director nominees, all of whom were returning, with no newcomers. All were overwhelmingly re-elected anyway.

Disney stock is now worth almost $20 less (20 percent) than it was on the date of the annual meeting. It just shows how all the institutional fund managers such as BlackRock and State Street, the proxy advisory services ISS and Glass Lewis, and pension fund managers and investing “experts” — all have limits to their understanding. They run in insular circles in which they affirm each others’ opinions, as do all the elitist executives who run these companies and serve on each others’ boards. They convince each other how great their ESG initiatives and diversity programs are, then are shocked when brands like Budweiser and companies like Target and Disney fall off a cliff.

As CNBC recounts, in 2004 Iger’s predecessor Michael Eisner was denied 43 percent of the shareholder vote for reelection as Chairman of the board. Eighteen months later he was gone as CEO and Iger was in charge. Shareholders can wield influence even if they don’t win a majority.

It’s past time for an overhaul of the majority of the boards of S&P 500 companies. They are uniformly woke and excessively clubby. We invite more of our fellow shareholders to join us in pursuit of that goal.