GOVERNMENT INTEGRITY PROJECT

NLPC “blows the whistle” on government officials and interest groups engaged in questionable and illegal activities, often based on original investigation and research. NLPC has filed formal Complaints with a variety of authorities and regulators, including the U.S. Department of Justice, Federal Election Commission, Internal Revenue Service, and Congressional Ethics Committees.

NLPC also supports government integrity by utilizing and promoting the use of the Freedom of Information Act (FOIA).

Kamenar on Cohen: ‘Warmed-Over Testimony by a Convicted Perjurer’

NLPC Counsel Paul Kamenar of National Legal and Policy Center offers his analysis of the latest in former President Donald Trump’s legal cases on NTD-TV. Click here to watch the interview.

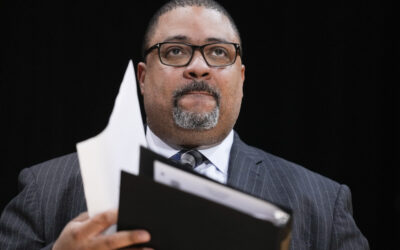

NLPC COUNSEL: New York Trump Trial is a ‘Sideshow’

Manhattan Criminal Court continues to hear testimony in former President Donald Trump’s business records trial in New York City. NLPC Counsel Paul Kamenar, tells NTD-TV the trial is a “sideshow,” with the testimony offering no evidence that incriminates President...

Maryland Senate Candidate David Trone Underreported His Assets

From a Washington Free Beacon story today by Andrew Kerr: It’s unclear how much Rep. David Trone’s stake in Indiana Fine Wine & Spirits is worth, but it’s enough that the Maryland Democrat pledged it as collateral for a loan worth up to $25 million in August 2020....

Federal Judge Questions Whether Dominion Energy Has Proper Approvals to Begin Offshore Wind Project

On Monday, D.C. Federal Judge Loren L. AliKhan convened an expedited status conference a few hours after a coalition of three public interest groups—The Heartland Institute, the Committee for a Constructive Tomorrow (CFACT), and National Legal and Policy Center...

WSJ Letter: Alvin Bragg is Robbing Trump to Pay Donald

Wall Street Journal letter to the editor by NLPC Counsel Paul Kamenar: Your editorial criticizing District Attorney Alvin Bragg’s hush money trial against Donald Trump (“The Trump Trial Spectacle Begins,” April 13) makes excellent points about how Mr. Bragg is vainly...

Trump Could Benefit if Supreme Court Strikes Down Obstruction Statute

https://youtu.be/vQm_EX_kuSE?si=ok_Dj4Bqa3VEFhdP NLPC Counsel Paul Kamenar attended the Supreme Court arguments today on the constitutionality of Section 1512(c)(2), obstruction of an official proceeding. He offered his analysis on One America News Network,...

Kamenar Tells WMAL That Alvin Bragg’s Case Against Trump is Based on ‘Crazy Theory’

https://twitter.com/NLPC/status/1780223451887792189

JUST THE NEWS: Conservative Groups Take Up ‘Save the Whales’ Cause

Over the weekend, Just the News published a report about the lawsuit brought by NLPC, CFACT and The Heartland Institute against the Biden administration and Dominion Energy over their failure to adequately protect the Atlantic Coast habitat of the right whale from...

Trump ‘Very Unlikely’ to Get Fair Trial or Impartial Jurors

Former President Donald Trump’s unprecedented “hush money” trial will begin with jury selection in New York on Monday. Paul Kamenar, lead counsel at National Legal and Policy Center, says President Trump is very unlikely to face fair and impartial jurors. To watch...

FOX NEWS: Whale of a Lawsuit Threatens Biden’s Wind Mandate

Writing for FoxNews.com, Fred Lucas explains the lawsuit against the Biden administration and Dominion Energy that was filed by NLPC, CFACT and The Heartland Institute, over the protection of whale species from destruction of their Atlantic Ocean habitat by offshore...

NLPC, Oil & Gas Workers Sue to Stop SEC’s Climate Disclosure Rule

National Legal and Policy Center has filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) to challenge recent regulations that force public companies to make extensive disclosures related to climate change. NLPC’s co-plaintiff is the Oil & Gas...

VIDEO: NLPC, CFACT, Heartland Institute Sue Biden Admin; Offshore Wind Killing Whales?

https://twitter.com/NLPC/status/1771182845798523100 Earlier this week three groups -- NLPC, CFACT, and The Heartland Institute -- filed a lawsuit against several Biden administration agencies and Dominion Energy for their insufficient protection of whale species while...

Groups Sue to Stop Offshore Wind Mega-Project That Threatens Endangered Whale Species

NLPC, along with the Committee for a Constructive Tomorrow (CFACT) and the Heartland Institute, today filed a lawsuit in the U.S. District Court for the District of Columbia against Biden administration officials and agencies seeking a preliminary injunction of their...

NLPC on TV: Anti-Trump Georgia Case Now ‘Damaged Goods’

NLPC Counsel Paul Kamenar offers his legal analysis of the latest developments in the Georgia election case against former president Donald Trump on NTD-TV Click here to watch the interview.

NLPC on TV: Supreme Court Colorado Ballot Decision is ‘a Very Good Ruling for Whole Country’

NLPC Counsel Paul Kamenar appeared on One America News Network with reaction to the Supreme Court's 9-0 decision that states cannot keep Donald Trump off the ballot.

Taxpayer-Funded, Pro-Censorship Group Still Hasn’t Disclosed Its Leadership

From the Washington Examiner by Gabe Kaminsky: A State Department-backed “disinformation” tracker under congressional investigation is shielding key details about its operations from the Washington Examiner despite blacklisting conservative media outlets...

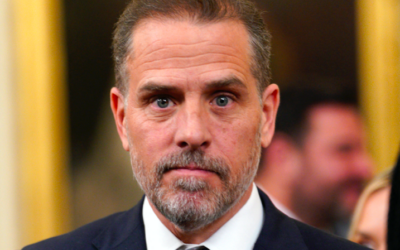

Lawyer’s ‘Loan’ to Hunter Biden Violates Legal Ethics

From Newsmax.com: The complicated relationship between President Joe Biden’s son, Hunter Biden, and entertainment attorney Kevin Morris is raising ethical and legal concerns amid the effort of House Republicans to prove that the president was involved in and...

NLPC on TV: Supreme Court Likely to Overturn Colorado Decision Kicking Trump Off Ballot

From NTD TV: Following an unprecedented decision from Colorado’s Supreme Court, former President Donald Trump is currently not a presidential candidate in Colorado. The Trump campaign has said the former president will appeal the decision to the Supreme Court. NTD...

What the Hunter Biden Tax-Evasion Indictment Means

The most remarkable thing about the tax-evasion indictment of Hunter Biden by now-Special Counsel David C. Weiss is that it happened at all. The second most remarkable thing is Weiss’s allegation that Hunter simply decided not to pay income taxes. According to the...

NLPC on TV: Kamenar Predicts Prison for Hunter Biden

12/8/23- NLPC Counsel Paul Kamenar is interviewed on One America News Network about the indictment of Hunter Biden in California as a special counsel investigation into the business dealings of President Joe Biden’s son intensifies. One...

Biden Super PAC Amends Disclosures After Trying to Hide Donors

From the Washington Fee Beacon by Andrew Kerr: President Joe Biden’s super PAC quietly altered its tax filings just three days after the Washington Free Beacon reported the group appeared to engage in an illegal scheme to hide its donors from the public. Future...