Last week “we told you so” about our call for the rejection of the entire Disney board at this year’s annual meeting, which went unheeded by our fellow shareholders. We outlined our arguments in a 27-page filing at the Securities and Exchange Commission earlier this year.

Now we also say “we told you so” as the prevalent winds grow stronger against the risky investment and business conducted by American corporations in the communist, genocidal nation of China.

The Epoch Times reported yesterday that House China Committee Chairman Mike Gallagher met with several Wall Street leaders this week, who “have expressed a general willingness to pull back investment from China.” According to the article, Rep. Gallagher was surprised to see a “general recognition that we need restrictions on US capital flowing to China in certain areas.”

Also from the Epoch Times report on Rep. Gallagher’s Wall Street meetings:

“Every day that we keep funding the CCP’s military ambition,” he said earlier at a hearing at Peterson Hall in Manhattan, “we make conflict in the Indo-Pacific more likely.”

And if China were to invade Taiwan, the losses across U.S. financial systems would “dwarf the write-downs taken at the outset of the Russia-Ukraine war,” he added. “The entire U.S. economy and banking system would be imperiled. Equity markets would drop precipitously as global shipping lanes closed, shipping insurance premiums skyrocketed, supply chains broke down, and the specter of global conflict grew. Americans would see their pensions shrink and their bank accounts hemorrhage cash.”…

The level of risk associated with doing business has spiked so much that U.S. companies have complained to U.S. Commerce Secretary Gina Raimondo, who recently traveled to China, that “China is un-investable because it’s become too risky.”

“American investors in China are like the proverbial frogs slowly boiling in a pot of water,” Mr. Gallagher said, adding that “taking on a genocidal, communist regime as a business partner is not a recipe for success,” but one for “systemic risk.”

Also Fox Business reported that former SEC Chairman Jay Clayton testified that large corporations need to provide greater disclosure of their risks in the country:

“This is an area where I would at least consider a pilot program for very large companies disclosing the China-specific risks and what sort of scenario planning they have done in the event of an abrupt decoupling,” Clayton told the panel. “This is not about liability, it’s not about ‘gotcha’ — it’s just about in the boardroom, if you have a substantial exposure to China, how have you thought about the type of risks that you’re talking about if they come to fruition and provide that information to investors.”

Last week we learned that BlackRock shut down a China-focused investment fund following increased scrutiny by Rep. Gallagher’s committee.

And now all of a sudden JPMorgan Chase Chairman/CEO Jamie Dimon has shifted his view on China. He visited the country in May for the first time since the COVID hysteria, excited to restart investor conferences in Shanghai while “The bank’s economists were optimistic about China’s post-COVID GDP growth,” according to Fortune. Now he says, “In terms of our own business, the risk-reward (from China), which was very good, has now become okay. The risk is bad.”

I’d say we at National Legal and Policy Center couldn’t have said it better ourselves — except we did say it, several times over, earlier this year.

During the spring — known as proxy season in the United States because of the heavy concentration of companies’ annual meetings — NLPC sponsored more than two dozen shareholder proposals. Of those, nine requested that various corporations to annually conduct an audit and issue a report on the extent that their operations depend on doing business in China. The “resolved” clause of our Walmart proposal is similar to our request to other companies where we brought the same proposal:

Shareholders request that, beginning in 2023, Walmart Inc. report annually to shareholders on the nature and extent to which corporate operations depend on, and are vulnerable to, Communist China, which is a serial human rights violator, a geopolitical threat, and an adversary to the United States. The report should exclude confidential business information but provide shareholders with a sense of the Company’s reliance on activities conducted within, and under control of, the Communist Chinese government.

The other companies where NLPC presented the “Communist China Risk Audit” proposal this year were Apple, Boeing, Comcast, Disney, General Motors, McDonald’s, Merck, and Starbucks. We have another on the proxy statement for Procter & Gamble, whose annual meeting is Oct. 10.

Of the meetings held so far, our proposals on China risk performed miserably in shareholder votes, ranging from 1.31 percent (Walmart) to 7.37 percent (Boeing) in support. This means that large investors in these companies, including asset managers (such as BlackRock, State Street, Vanguard and Fidelity), and large state pension fund managers — many which outsource their proxy votes to pro-ESG investment advisory firms, regardless of whether the states are run by Democrats or Republicans — all voted in opposition to our China proposals.

Now we hear that big-time Wall Street investors, financial gurus and corporate leaders are complaining to our Commerce Secretary that “China is uninvestable because it’s become too risky?” Where were they four or five months ago when we asked for transparency for the same reasons?

NLPC told you so about Disney’s weak, ineffective board of directors. We told you so about the need for transparency at Meta over its “Facebook Files.” And we told you so with our expression of the need for greater risk disclosure with China from Corporate America.

Maybe we will get more support for our proposals next year as a result.

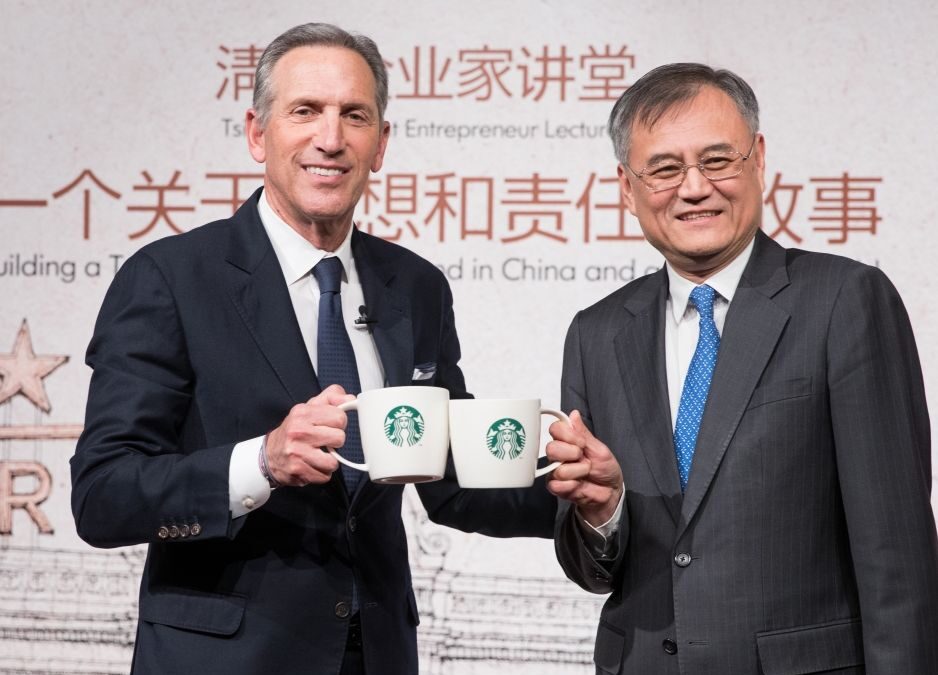

(Pictured above: Starbucks director and former CEO Howard Schultz at Tsinghua University)