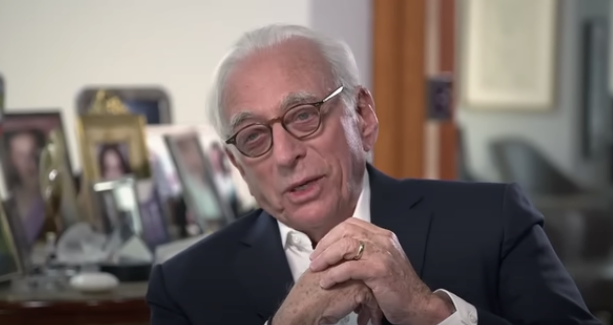

Early this year activist investor Nelson Peltz (pictured above) and his Trian Fund Management took a big stake in The Walt Disney Company, and demanded a seat on the board of directors, accompanied by a threat to run a competitive campaign at the annual meeting in April.

But his saber-rattling, which was met with equally aggressive resistance by Disney and by reinstated CEO Bob Iger, lasted less than a month. Trian cited the company’s reorganization plans, which included at least 7,000 layoffs, as the reason for backing away.

It’s easy for us (NLPC) as fellow shareholders to say, especially in hindsight, but Peltz should have kept the pressure on, because the company’s performance has only worsened since then. The board got no fresh blood, instead choosing to return its incumbent members save one (reducing its ranks by one), and now its share price has dipped even lower since the annual meeting.

As Derek Saul at Forbes outlined yesterday, Disney’s stock has hit a nine-year low, even less than when Peltz was clamoring for change:

Since October 2014, Disney’s 12% return compares to a roughly 130% jump for the S&P 500, while Disney’s 25% loss over the last five years and 55% gain over the last 10 years compares to the S&P’s 53% and 170% respective gains over the periods, according to FactSet data…

Disney is the 78th-worst performing stock over the last 10 years out of the 468 S&P companies who have been publicly traded during the period.

In the entertainment sector, Netflix’s more than 900% gain over the last decade dwarfs Disney’s, while other fellow long-time large-cap stocks like Apple, Microsoft, Amazon, Berkshire Hathaway and Coca-Cola have all outperformed Disney.

Disney, whose $178 billion market capitalization made it the 31st most-valuable company in the world in 2015, is now the 69th-largest firm, with a market cap of $154 billion.

As I noted earlier this month, Disney’s four major revenue generators — theatrical releases, traditional “linear” television, streaming, and theme parks — are being dragged down by changing viewing habits but more so by “woke” programming.

While Peltz may not have been the investor to call Disney to account for the wokeness that is destroying the company, he at least would have been a stronger voice for cutting excess and improving the bottom line. Indirectly that might have helped excise some of the company’s progressive politics and LGBT advocacy towards children.

But instead the board elevated Nike chairman Mark Parker to also chair Disney, and leftists like Iger, Amy Chang and former Clintonite Michael Froman remain entrenched. Besides them, Disney’s board has General Motors Chair/CEO Mary Barra and WE Family Offices CEO Mel Lagomasino (who also is lead independent director for Coca-Cola), both of whom have more pressing priorities than the Disney disaster to worry about.

The only existing Disney director who could be possibly be identified as “not woke” is Oracle CEO Safra Catz.

For the record, NLPC has submitted to Disney’s board governance committee another director candidate. He is a recognizable name, widely respected, with an accomplished career in public service. But so far the company has not acknowledged receipt of our formal recommendation, which is in keeping with our experience with the company. We have seen nothing but disrespect for shareholders (see page 26 here).

It looks like that is the treatment that Nelson Peltz received too (as also noted in the previous link). We have also noticed that after cutting his Disney stake by one-third (from 9.4 million shares at the beginning of the year), in May he bought an additional 500,000 shares. According to Reuters columnist Lauren Silva Laughlin, this is a strategy that Peltz consistently follows:

Peltz’s history shows he doesn’t need to be in the boardroom to shake things up. One example is chemical maker DuPont. Peltz first revealed a stake in 2013 and two years later made a bid to get onto the board during the shareholder-meeting flurry that U.S. companies call proxy season. He lost. But he held on to the stock and pushed from the sidelines, and ultimately got what he wanted: the return of chieftain Ed Breen and a merger with Dow.

There’s also Peltz’s high-profile war with [Procter & Gamble]. An acrimonious bid for a board seat at the household-product maker ended in failure after shareholders voted against him – or so it seemed initially. A recount suggested he had won, and the company began to challenge this new result – but then folded and named him onto the board anyway. Even after all that, then-CEO David Taylor worked closely with Peltz to reshape P&G.

Perhaps we are only in Act II of another Peltz three-act drama.