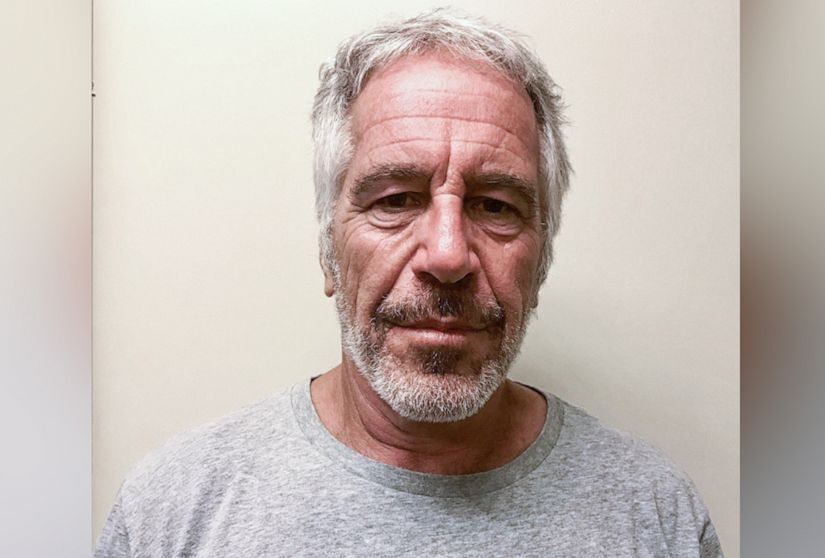

Today, National Legal and Policy Center and our allies at the Free Enterprise Project have called out JPMorgan Chase & Co. for knowingly letting sex trafficker Jeffrey Epstein use his bank accounts to fund his illicit activities for years, but canceling the accounts of some conservative political activists.

NLPC and FEP put out a joint press release addressing the issue:

Following the disclosures released last week that megabank JPMorgan Chase & Co. (“Chase”) knowingly allowed sex trafficker Jeffrey Epstein to maintain accounts with which he made multiple payments to his victims – collectively exceeding $1 million – two shareholder groups are pointing out hypocrisy at the bank, and are calling upon it to implement transparency measures and to disclose its policies about whom it does and doesn’t provide services to.

According to information in a federal lawsuit by the government of the Virgin Islands against Chase, as early as 2006 the bank’s Global Corporate Security Division flagged “[s]everal newspaper articles . . . that detail the indictment of Jeffrey Epstein in Florida on felony charges of soliciting underage prostitutes.” According to a report by LawAndCrime.com, four years later Chase’s risk management division raised questions in an internal email about fresh accusations against Epstein. “See below new allegations of an investigation related to child trafficking – are you still comfortable with this client who is now a registered sex offender[?]” The concerns were dismissed and Epstein’s accounts at Chase remained open.

Both National Legal and Policy Center and the Free Enterprise Project at the National Center for Public Policy Research own stock in Chase, and have introduced shareholder proposals (NLPC’s, FEP’s) that address different aspects of the company’s troubling practice of closing accounts of conservatives without warnings or honest explanations. In their respective proposals, both NLPC and FEP cite past examples where Chase has “de-banked” activists and organizations, including the nonprofit National Committee for Religious Freedom, which “proactively defend(s) the constitutional rights of religious freedom” for “all Americans.” The NCRF was founded by Sam Brownback, the former U.S. Ambassador-at-Large for International Religious Freedom. Ambassador Brownback also served honorably as a Congressman, U.S. Senator, and Governor for the state of Kansas. Chase shuttered NCRF’s account in May 2022, three weeks after Brownback opened it, and has and since then provided false explanations, and then stonewalled about the reasons for the closing.

Only now, Chase is asking the Securities & Exchange Commission to let it exclude both proposals (NLPC, FEP) from being presented at the company’s annual meeting of shareholders, in an attempt to evade accountability for its discriminatory de-banking practices.

“This is evil; Chase let the cash flow to aid and abet Jeffrey Epstein’s sick and disgusting global sex trafficking operation,” said Paul Chesser, director of NLPC’s Corporate Integrity Project. “But they shut down its services to a praiseworthy and respectable initiative by an upstanding public servant, and want to hide the reasons for it all from shareholders. The bank is obviously embarrassed and it should be.”

“Chase is a too-big-to-fail bank, so it gets to keep its profits, while all taxpayers – not just leftwingers – backstop its losses,” said Scott Shepard, Director of FEP. “Chairman and CEO Jamie Dimon talks a good game about recognizing the folly of woke corporate governance, apparently without realizing that that’s how his shop is run. After these Epstein revelations, it’s time for Congress and the states to investigate Chase and to bar it from doing business until it ends its petty partisan discrimination.”