Goldman Sachs will host its annual meeting in Dallas next Wednesday, April 26, and National Legal and Policy Center will ask its fellow shareholders to vote on a proposal to implement a policy to require the Chairman and CEO positions, currently occupied by David Solomon, to be held by two different executives.

The leader of the iconic Wall Street bank has retained both roles since he was elevated to Chairman in January 2019, only three months after he was named CEO. The company has had several stumbles and unforced errors under Solomon’s watch, and NLPC will argue at the shareholder meeting that a separate counterpart as chairman, creating more accountability for the CEO, represents a stronger corporate leadership structure.

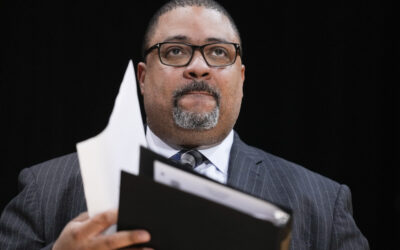

“David Solomon is yet another ‘woke’ big bank CEO who immerses Goldman Sachs needlessly in political virtue-signaling that later brings disrepute on the company,” said Paul Chesser, director of the Corporate Integrity Project for NLPC. “There are countless examples, but perhaps the biggest sin of this New York City financial icon was to back anti-police Black Lives Matter initiatives, and now ‘Gotham’ has predictably become crime-ridden and less populated. We may see Snake Plissken roaming the streets before long.”

In a filing with the Securities and Exchange Commission in support of its proposal, NLPC highlighted several examples of Solomon’s leadership stumbles, including:

- placing Goldman Sachs as a member of the Net Zero Banking Alliance and participating in the federal government’s voluntary Task Force on Climate-Related Financial Disclosures. Net Zero targets are unrealistic, unnecessary and violate fundamental tenets of the scientific method, and related policies have contributed significantly to high energy prices;

- leading the Company in a joint effort with several other corporations and labor unions to pressure the Trump administration to keep the United States in the non-binding Paris Climate Agreement, which was never ratified by the U.S. Senate, and does not require compliance to similar standards by China and India;

- signing a statement “opposing ‘any discriminatory legislation’ that makes it harder for people to vote,”in opposition to the Georgia Election Integrity Act, which is now a law that saw no diminished voter turnout in 2022;

- forcing diversity requirements on its client companies, while internally at the bank African-Americans and women make up 3 percent and 29 percent of senior management roles, respectively;

- allegedly using his relationships with Goldman Sachs clients to promote his EDM DJ career;

- reportedly using the company’s private jets for personal travel, despite a policy to limit such use — going as far as to book seven trips over seven consecutive weekends, according to the New York Post;

- demonstrating personal conduct that reportedly led to Goldman Sachs reaching a $12-million settlement over its “sexist culture,” with Mr. Solomon allegedly boasting “about his sexual prowess;”

- forays into retail banking and lending enterprises Marcus and GreenSky, which were jettisoned after barely getting started.

“Goldman Sachs works its junior bankers an average of 98 hours a week, while Mr. Solomon prioritizes useless Net Zero gambits and promotes his side hustle,” Chesser said. “Really we are going easy on him by asking the board to just make him either Chairman or CEO, but not both.”

NLPC has also filed a report with the SEC in support of a shareholder proposal sponsored by the National Center for Public Policy Research, which seeks a congruency report about Goldman Sachs’s China-focused ETFs to assess whether they are aligned with the company’s commitments to support human rights. NLPC also opposes three shareholder proposals that seek adherence to Net Zero priorities and an end to the company’s funding of fossil fuel development.